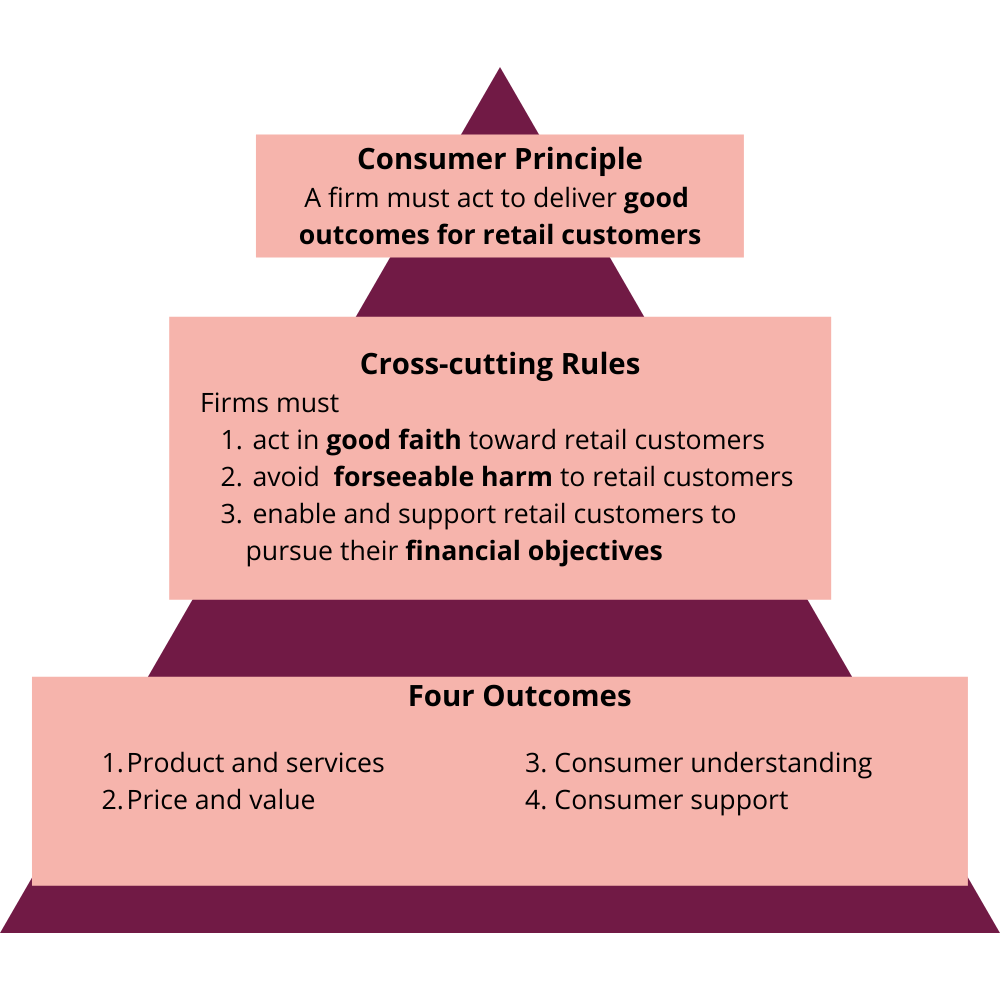

The new Consumer Duty rules set a high bar for firms in the way they manufacture, sell and service insurance products to retail consumers. The FCA are seeking to create a baseline standard that will ensure innovation and competition exists in the interests of the retail consumers firms serve. They are seeking to eradicate the scenario of profit driven by consumer confusion and exploitation.

The new Consumer Duty applies to all retail customers – the scope follows the position in the Insurance Conduct of Business Sourcebook (ICOBS). Retail customers are defined as “an individual who is acting for the purposes which are outside their trade, business or profession”.

It applies to actual and prospective customers given the scope of the new rules, particularly around consumer understanding, where so much of that understanding is set out prior to the contract being effected.

Firms throughout the distribution chain, who manufacture or distribute products intended for retail customers, are directly affected by the new Consumer Duty rules, even if they are not in direct contact with the customer. They need to consider how their role, which is likely to vary by individual product and distribution agreement, covers issues such as:

- the design, manufacture and servicing of retail products or services, including their price and value;

- the distribution models used;

- preparing and approving communications that are to be issued to retail customers; or

- their role in providing customer support to customers.

These obligations are not mutually exclusive – in many distribution chains, the responsibility is likely to be shared to some extent and the new Duty used the term ‘material influence’ to determine whether a firm has a responsibility or not. As a small aside, firms may wish to revisit their distribution agreements to ensure the language used to set out their respective obligations is consistent with the new Duty. It will help avoid ambiguity with the regulator in the future.

The Consumer Duty

The Duty is fundamentally as planned in the previous consultations. You can read more about that in our previous article: A New Consumer Duty – Raising the Bar In The Best Interests Of Customer Outcomes.

The outcomes reinforce what is already clearly set out in the FCA Handbook. Under PROD 4.2.14R , a firm manufacturing a product. For example,

“… must ensure the manufacture of an insurance product is driven by features that benefit the customer and not by a business model which relies on poor customer outcomes to be profitable.”

In the case of price and value, PROD 4.2.14E says that:

“…‘value’ means the relationship between the overall price to the customer and the quality of the product(s) and/or services provided.”The Duty has not introduced new rules to PROD 4, as the FCA feel that if firms are complying with the current PROD 4 requirements, including Fair Value, they will meet the Product & Services and Price and Value Outcomes. This is good news for firms, as we know many of our clients have been developing new product approval and review documentation since October 2021. As long as these comply with PROD 4 requirements, they will not need to be amended as a result of the Consumer Duty being introduced.

In regards to “Fair Value”, the FCA stated that a product which is designed to meet the needs of its target market, is transparently sold, and for which consumers are properly supported, is generally likely to offer fair value. Firms may find this guidance useful when defining internally what “Fair Value” means for the firm.

However, the Consumer Duty does require firms to look carefully at how they meet the new requirements and most importantly, how they evidence to the regulator that they are doing so.

Application of the new Consumer Duty

The new Duty applies to all firms doing business in the UK. It also applies to:

- Gibraltar firms selling products or services to UK customers;

- Firms in the Temporary Permissions Regime;

- UK distributors of products manufactured by a non-UK firm

- Principals overseeing the actions of Appointed Representatives, an area that is itself also waiting to see what the next phase of regulatory oversight will look like.

So for example, firms who have set up a reverse branch in the UK as part of their Brexit solution, that branch is required to comply with the new duty.

The FCA have recognised the issue of UK manufacturers selling to non-UK customers via non-UK distributors and the difficulties UK firms could face if those distributors, not subject to the FCA rules, refuse to share relevant information needed to comply with the Duty. In this situation, manufacturers should use any available information to support their work under the Duty, but would not be expected to obtain information from firms that are not subject to the Duty.

The Duty will not be used to retrospectively hold firms to a higher standard for products already sold, but will apply on a forward looking basis to open and closed products where new actions are taken.

The Duty, has introduced a new first tier Conduct Rule, meaning it is applicable to most staff at your firm.

The new rule 6 says:

“You must act to deliver good outcomes for retail customers”

It will be implemented on 31 July 2023. Firms will have to provide training on the new conduct rule to staff and update necessary documentation, like employee handbooks, by that date.

Governance

The rules require firms to ensure their strategies, governance, leadership, and people policies (including incentives at all levels) lead to good outcomes for customers. The rules also make clear that the FCA expect customer outcomes to be a key lens for important areas, such as Risk and Internal Audit

A firm’s board should review and approve an assessment of whether the firm is delivering good outcomes for its customers which are consistent with the Duty, at least annually. In line with this, board’s will be expected to review relevant Consumer Duty MI, with an annual report required to be provided to the Board, which sets out how the firm has complied and will continue to comply with the Consumer Duty.

Firms are required to have a “Consumer Duty Champion” at Board level, who along with the Chair and CEO, ensure that the Duty is discussed regularly at Board meetings. The champion should be an Independent Non-Executive Director, where possible.

Boards will also be required to update their terms of reference, to include the extra responsibilities that the Consumer Duty brings. Firms will also need to ensure Consumer Duty responsibilities are cascaded down to other relevant committees, for example, Executive Management or Conduct Risk Committee’s, with their terms of reference also requiring the requisite updates.

Firm’s must now expect at every stage of the regulatory lifecycle to be asked by the Regulator to demonstrate how their business model, the actions they have taken, and their culture are focused on delivering good customer outcomes.

How Will The FCA Monitor Firms?

The FCA has been clear that it is putting data at the heart of its methods of working. The responsibility for capturing and providing that data sits with regulated firms and the FCA will use that data to help it understand compliance. In the case of the Consumer Duty, it has highlighted a couple of key areas it will consider:

- Financial Ombudsman Service complaints: the final decisions on complaints will give the FCA a clear view on how consumers have been treated with regard to issues such as the fairness of fees and charges as well as the appropriateness of the products and services sold to those consumers;

- Financial Lives Survey: in our view, this is a hugely valuable service the FCA are now making available to firms. Its outcomes help the FCA understand, at a market-wide level, how consumers feel about a range of issues related to the manufacture, sale and servicing of insurance products. We strongly recommend firms look closely at the outcomes as it will shape future FCA action. (You can more information about it on the FCA website).

The focus is on understanding the change in outcomes consumers experience across the four outcomes.

- Fair value: are there fewer complaints about product value and unexpected fees and charges?

- The suitability of products and services: complaints relating to products and services not working as expected will be key to evidencing improvement here.

- The suitable treatment of consumers: the FCA will be looking at how consumers have been able to amend, switch and cancel products and the nature and volume of complaints related to this.

- Consumer confidence: the Consumer Duty is not going to instil a new level of trust in financial services firms quickly, but the FCA have clearly set out to try and change the image of the industry. It’s an area that will be hard for individual firms to measure but the objective of ensuring consumers have the right information to make good decisions is one that will more easily be measured at individual firm level.

Firms can expect to see a more hands-on approach to the monitoring of the implementation of the Consumer Duty. The guidance given by the FCA is that firms should expect to have an equivalent approach to the MI used to measure consumer outcomes that they use to inform other elements of their business, such as product development and sales.

We strongly advise firms to document their planning and processes for this as the FCA have made it clear firms can be expected to be asked to share this approach to monitoring the Duty with them.

The FCA proposes sharing best practice with firms to help improve the overall industry response – the message is clear. The FCA expect to see industry wide improvements and whilst innovation and competition are key objectives, they want to see consistency in how that is measured to help drive fairness for everyone.

When Does the New Consumer Duty Take Effect

Firms have 12 months to implement any changes necessary to comply with the new rules. This timescale was the key issue raised by firms and industry bodies in the feedback given to the FCA on the last Consultation Paper.

Products and services that are being sold as part of a firms’ current portfolio must comply by 31st July 2023. Firms have some additional flexibility to bring closed products into line – they must be compliant by 31st July 2024.

The FCA have been quite explicit that firms need to act sooner rather than later and have set out a roadmap for implementation with some specific milestones. It refers to this as an ‘assertive approach’ and is designed to reduce the risks of failure to act in the manner expected by firms. The key deadlines in the timetable leading up to the implementation date are:

- October 2022: your board is expected to have agreed an implementation plan by the end of October. You are likely to be asked to share these with the FCA – be prepared to do so. Note that the FCA expect the board to have oversight of the whole process, so plan for this to be a standing agenda item over the next 18-24 months as your firm responds to the change and monitors the effectiveness of your delivery of that change.

- April 2023: product manufacturers must have completed all reviews related to the four outcomes by this date and share key information with their distribution networks. However, even though PROD 4 compliance is achieving compliance with Outcomes 1 and 2, this has not pushed back the October 2022 deadline for firms to approve their products and distribution arrangement, under the new PROD. For firms such as an MGA, who will likely have only a single or small number of manufacturers they work with, meeting your own obligations under the Consumer Duty may not be too complex. But for more traditional distribution firms such as insurance brokers, who deal with a large number of manufacturers, the period from May to July 2023 could be busy.

- May to July 2023: this is the timeframe within which the FCA expects product manufacturers to be identifying changes required to open products and making those changes.

Reasserting the importance of these changes, the FCA have mandated that firms must tell them if they believe they will not be able to complete all necessary work before the implementation deadlines. The obligation arises at the point that becomes clear and this is most certainly not a scenario where being first is a good thing.

Lastly, whilst withdrawing products or services from sale might be an appropriate decision in certain circumstances, firms should be aware that if they choose to do so, they must:

- Consider the potential impact on vulnerable customers;

- Notify the FCA if they identify any impact on vulnerable customers or on overall market supply; and

- Ensure they are compliant by 31st July 2024 in relation to the aspects of the Consumer Duty that relate to closed products.

Conclusion

The Consumer Duty is going to require all firms to give significant consideration to the way they manufacture, distribute and service retail business. It places significant obligations on boards to oversee the necessary changes and makes it clear that implementation will be actively monitored by the FCA. With key deadlines provided, the first of which is only 3 months away, firms cannot put this off until ‘after the summer’. Planning needs to start now.

In the short term, firms are on their own in how to approach this. Whilst the FCA have promised to share best practice examples as they become apparent, that is unlikely to help firms in the initial implementation phase. ICSR is well placed to assist firms, utilising our broad experience to help firms understand the issue, plan and manage the necessary changes across their business.

If you would like to discuss any aspect of the way the new Consumer Duty affects your firm, please speak with Kenneth Underhill or any member of the ICSR team.