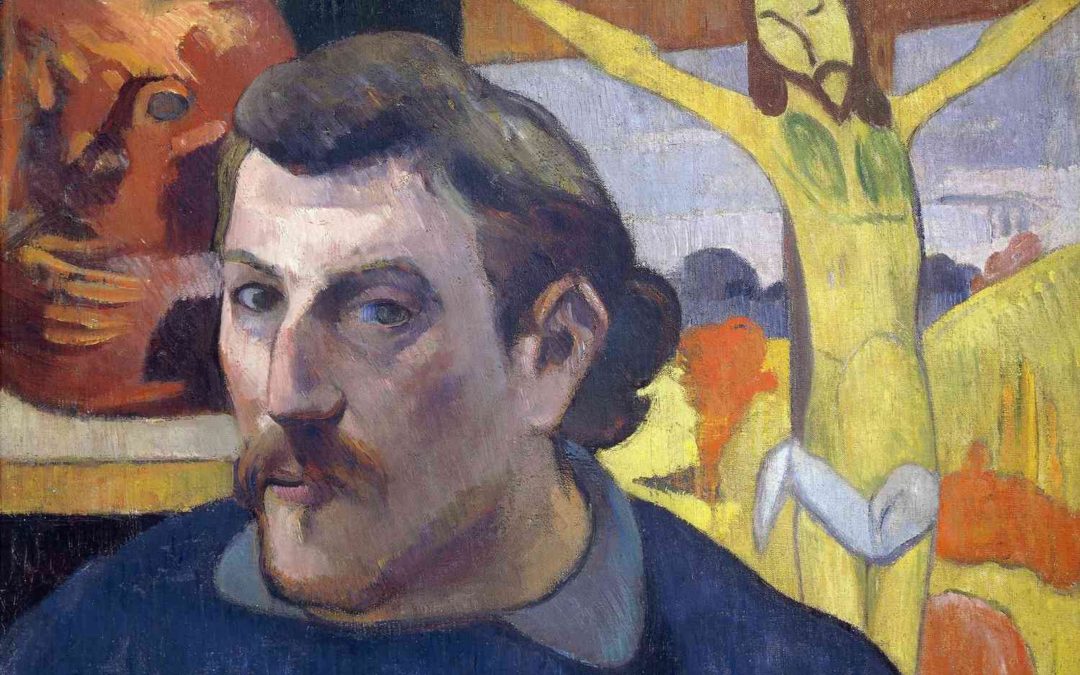

The artist Paul Gaugin is reputed to have said that “art is either plagiarism or revolution”. When I set out to build this business (over 6 years ago now) my over-riding objective was to create a different type of consultancy, one that truly offered something a little different, and the evidence is that our form of artistic revolution is proving popular.

12 months ago I reflected on the fact that ICSR had been through something of a revolution, with a fundamental shift in our growth trajectory that had been driven by our increasing reputation for being able to effectively and efficiently help clients manage regulatory change, investment cycles and drive business transformation. As I sit here now and look at where the last 12 months have taken us, I can only conclude that our revolution is far from over, and it is through seeking to offer something different that we have sustained our revolutionary approach.

A year ago, I was talking about a 65% uplift in turnover. Our turnover in the last 12 months has increased exponentially from that point. Last year, I looked at the way three key metrics had driven our growth in 2021/2022 and it is interesting to pause for a moment and consider what those metrics look like now.

-

- Turnover:our revenue growth in the last 12 months has more than doubled compared to the 12 months ending September 2022, a more significant shift than I reported last year. It continues to come from a mix of Insurers, Lloyd’s Managing Agents, Brokers & MGAs.

- Clients: we continue to work for a mix of new and existing clients, with a good level of new clients but equally a good retention of existing clients evidencing our ability to provide and increase the services that they enjoy. You can see details of some of the clients we have worked for here and read some of their testimonials here. One change is the number of new clients that are themselves new businesses – often without even a brand name at the time we are first engaged.

- Our Team: our growth would not be possible without having great people. We have added to our full-time team this year and significantly increased the depth within the Talent Pool. You can meet our team and search our Talent Pool here. The team is now well over 50 strong, and growing as our reputation spreads.

The turnover may be the headline, but our business is built on the foundation of having great people that have themselves held senior roles within insurance firms and understand the challenges our clients face. I talked last year about one of our key decisions being to build an HR function within our business and there are 3 facets to that role within ICSR. They are:

- Finding the right people to continue adding strength and depth to our Talent Pool and team. We have almost doubled the size of the Talent Pool in the last 12 months, with more now engaged with clients at any given point in time than in previous years. If you are already consulting, or considering moving from full-time employment to a consulting role, do please speak with us to see if the Talent Pool is right for you. Many of our Talent Pool members join us because they already know someone in the team.

- Helping clients find great talent to fill temporary vacancies, perhaps for maternity cover or until a full-time resource can take up a role.

- Providing an advisory service to clients addressing the various HR-related issues that come with so much of the regulatory and transformative change businesses must now address.

During the year we have identified further improvements that we can make to this function in order to develop the service we provide to our clients, and we will be progressing with these very soon.This year we have worked on building out two further areas within ICSR: Risk and Operations and IT. We have brought in senior market individuals to be responsible for their development in Claire King and Benoit Steulet respectively. Both have made a cracking start to their time at ICSR and are already making their mark and developing their teams. There is so much going on in the market including the changes to the Financial Services and Markets Act aimed at reducing some of the Solvency II requirements and what feels like a significant increase in risks faced by insurers generally through financial stress and climate change that the Risk Team is going to be very busy. On the Ops and IT side BluePrint II alone will be keeping many very busy including our Ops and IT Team.

Our people need great leadership and direction and I’m very grateful for the support from all of the leaders in our business in that regard. Not only do they provide advisory support to clients personally, but they also help oversee the work of Talent Pool members in their specialist areas, as well as working to make sure we only have the very best people on the team and in the Talent Pool. You can meet the wider team here.

Collectively, our people deliver two main types of service to our clients – advisory and resourcing. There is a continual subtle shift in the balance of work between the two, but our business model allows us to be very flexible in how we work with clients. That flexibility has also resulted in a much broader functional balance in the last 12 months, with the depth of our Talent Pool resources allowing us to help clients in many more ways. Some of our key engagements have included:

- Assisting a continental insurer with a real focus on InsTech seek authorisation to create a UK insurance business;

- Undertaking work for a variety of clients on Consumer Duty, helping ensure their readiness for the new regime in July;

- Completing ORSA and qualitative risk framework enhancements;

- Helping European firms set up UK branches;

- Helping clients undertake strategic evaluation work such as due diligence exercises for acquisitions or pre-investment purposes;

- Assisting clients with their analytics build and data migration;

- Undertaking various compliance and risk reviews and working on evolution of those functions when necessary thereafter; and

- Providing temporary resources to clients in a range of roles, including Risk, Compliance, Sanctions, IT, Operational Resilience, Consumer Duty and others.

We continue to publish anonymous case studies that explain the way we help clients across a wide range of areas – please do take a look if you would like to know more about the type of work we undertake.

One thing that has really struck me is how our reputation has become increasingly international. We have helped clients from the US, Europe, Asia and Australasia in the last 12 months, with our support increasingly being valued at a much earlier stage in the strategic decision-making cycle on investing in the UK market. With the PRA and FCA now both given their secondary objectives to help drive growth, I expect we will continue to see increased levels of international investment in the UK insurance market, and ICSR is well-placed to offers its expertise and resources to those firms.

On the subject of international business, I ventured to the Rendez-vous de Septembre in Monte Carlo last month. My first trip in a very long time. It was most certainly a very international affair. My personal highlight was a conversation with Tom Gallagher about ‘plumbing’ – if you would like to know more about that conversation, the video is below or you can take a look at all of my video blogs from the event here.

The FCA has been very focused on embedding the concepts of fair value for consumers in recent times and the implementation of the Consumer Duty in July gave yet further impetus to that work. The recent release of the latest Fair Value measures data has also put the spotlight on firms who, in the eyes of the FCA at least, have not yet fully addressed its concerns. With that in mind, I am very excited by the collaboration we have entered into with VisRisk to help clients manage these issues. This is the beginning of our strategy to be able to provide technology solutions to our clients. Like all of our solutions we will be aiming to provide practical solutions which have been built by people and for people within the market.

I hope by now you have already heard me talk about how effectively this tool can transform the way firms streamline and evidence their fair value compliance. The data collection and analysis provided by VisRisk is designed specifically to help firms avoid being put under the spotlight by the Regulator, with its ability to quickly highlight areas of Product Governance that require further investigation. We are currently working with VisRisk to develop the offering to include a full solution to evidencing and reporting on Consumer Duty and meeting the required FCA Outcomes. If you would like to know more about the tool, please speak to myself or any of the team.

In the last 2 years, year-end has also been a time of change for our business, with office moves. Thankfully, this year, we are staying put in Lloyd’s, despite all the change the corporation is itself currently undertaking. If you are in the building, or passing, and would like to pop in for a coffee, do let me know. We are always delighted to welcome visitors.

I’d like to conclude with a thank you. Firstly, to those of you who have trusted us to help your firms manage your own regulatory change and transformation. Your trust remains one of my primary areas of focus and is something none of us at ICSR will take for granted. And secondly, to everyone who has worked with and for ICSR in the last year, without whom none of this would have been possible.

Thank you.