The new Consumer Duty is raising the bar when it comes to delivering positive outcomes for customers. The need for this is a recognition that the ‘Best Interests Rule’ it seeks to replace has not delivered the outcomes the FCA hoped for and there is a clear sense that greater accountability is required at the very top of financial services firms to protect consumers.

If you sit on the board of an insurance firm, take note. The Consumer Duty sets a higher standard of care and expectation beyond the current set of Principles and rules.

“The new duty will drive a change in culture at firms. We expect firms to step up and put consumers at the heart of what they do and we’ll be holding senior managers accountable if they do not.”

(Sheldon Mills, Executive Director of Consumers and Competition at the FCA)

Background – The Customers Best Interests Rule

The Customers Best Interests rule is a legacy of our EU membership, first introduced as part of the Insurance Distribution Directive. The current rule says:

“(1) A firm must act honestly, fairly and professionally in accordance with the best interests of its client (the client’s best interests rule).”

Over a number of years, the FCA has been flagging concerns that it fears the rules do not go far enough and it has put a lot of work into understanding consumer sentiment on this front. In the 2020 Financial Lives survey:

- only 10% of consumers ‘strongly agreed’ that they had confidence in the UK financial services industry, with a further 32% ‘slightly agreeing’.

- only 35% of respondents agreed that firms are honest and transparent in their dealings with them.”

Those numbers do not make happy reading for the insurance industry and a combination of this insight, together with feedback from its supervision and enforcement activity have clearly led the FCA to conclude that stronger consumer protections are required.

The question of raising the standard of consumer protection was debated in Parliament during the passage of the Financial Services Act 2021. In CP21/13 earlier this year the FCA set out the initial basis for introducing the New Consumer Duty. CP21/36, issued on 7th December 2021 details the feedback received and the revised proposals.

Change is coming and it is going to both raise the bar and place the focus squarely on the board of directors to ensure it happens.

Background To The New Consumer Duty

In the consultation paper, the FCA make it very clear that what they are seeking to achieve is the creation of a level playing field, such that poor customer outcomes are not a consequence of firms keeping costs down through the lowering of standards. The FCA seeks to create a principles based approach that will create a minimum set of standards which all firms in the market must adhere to.

These principles are designed to address FCA concerns that arise from scenarios where consumers are:

- finding it harder to make an informed or timely decision;

- receiving unsatisfactory support from their provider;

- buying products and services that are inappropriate for their needs, of inadequate quality, are too risky or otherwise harmful.

The FCA have identified some specific actions being taken by firms which are resulting in harm. These are:

- Firms exploiting consumers’ behavioural biases, for example with online sales journeys that are intentionally misleading;

- Firms selling products and services that are not fit for purpose or are not designed for the consumers they are being targeted at and sold to;

- Firms selling products and services that do not represent fair value;

- Firms providing poor customer support that hinders consumers from taking timely action to manage their financial affairs and making use of products and services or increases their costs in doing so;

- Firms exploiting consumer loyalty or inertia;

- Other practices which hinder consumers’ ability to act, or which exploit information asymmetries, consumer inertia, behavioural biases or characteristics of vulnerability. (Think ‘fair treatment of vulnerable customers’ and you will understand where the FCA are coming from with this.)

It is clear that the FCA do not feel existing rules give them sufficient ‘teeth’ to address these actions, despite some of the feedback to CP21/13 suggesting it did.

A New Consumer Duty – The FCA Objectives

The FCA have proposed an outcomes based approach with the new Consumer Duty rather than prescribing specific steps. The detailed rules and guidance that are being consulted on are designed to help firms understand the FCA expectations, with firms needing to decide what changes they need to make to meet the expected outcomes.

The FCA are seeking to bring about a fairer, more consumer‑focused and level playing field in which:

- firms are consistently placing their customers’ interests at the centre of their businesses;

- competition is effective in driving market-wide benefits, with firms competing to attract and retain customers based on high standards and customer satisfaction, and innovate in pursuit of good consumer outcomes;

- regulation keeps up with technological change and market developments so that:

- consumers are protected from new and emerging harms; and

- firms can innovate to find new ways of serving their customers with certainty of regulatory expectations;

- firms extend their focus beyond ensuring narrow compliance with specific rules, to also focus on delivering good outcomes for customers;

- firms consider the needs of their customers – including those in vulnerable circumstances – and how they behave, at every stage of the product/service lifecycle;

- firms continuously learn from their growing focus on and awareness of what their customers experience;

- in line with the FCA work on diversity and inclusion, firms act to meet the diverse needs of their customers;

- consumers get the products and services they need, which are fit for purpose, provide fair value and do not cause them harm;

- consumers understand how to use firm’s products and services and receive the support they need to do so; and

- consumers get prompt and appropriate redress when it is due to them, with reduced misconduct ultimately reducing redress costs.

It is probably of no great surprise that in general, feedback from consumer organisations appears to be far more positive about the proposals than from industry organisations who have raised concerns about proportionality, design and unintended consequences. That said, many firms have also identified this as an opportunity to improve the general consumer perception of financial services firms and see the wider benefits from enhancing the reputation of the insurance industry with consumers.

Insurance firms will be pleased to hear that despite a call for a Private Right of Action (PROA) under the new duty, the FCA have concluded that it is not appropriate to introduce this, at this stage at least.

The New Consumer Duty

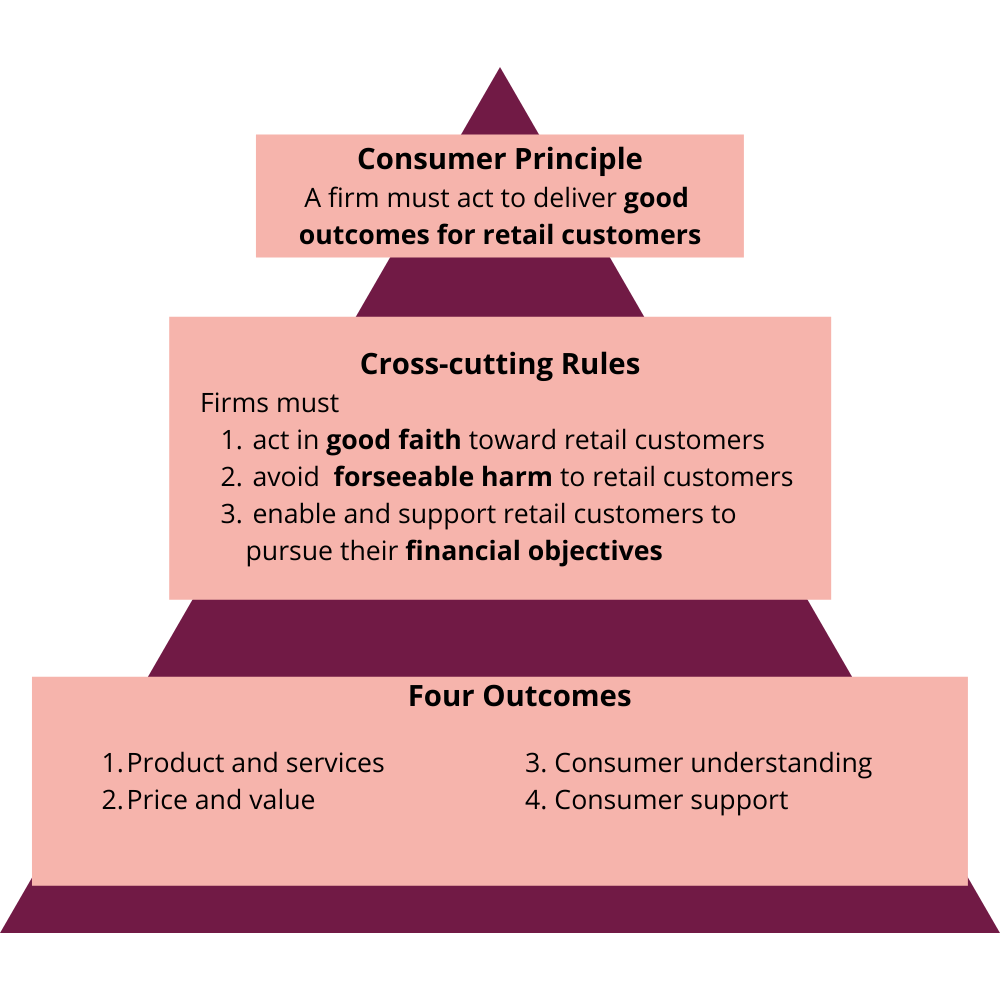

The new consumer duty will comprise:

- A Consumer Principle which reflects the overall standards of behaviour the FCA want to see from firms and which is developed by the other elements of the Consumer Duty.

- Cross-cutting rules which develop the overarching expectations that apply across all areas of firms’ conduct.

- Four outcomes which give more detailed expectations for the key elements of the firm-consumer relationship.

There have been some key changes based on feedback to the initial consultation.

Consumer Principle

“A firm must act to deliver good outcomes for retail clients”

The Consumer Principle would impose a higher standard of conduct than Principles 6 and 7 in the FCA Handbook currently do. Perhaps slightly confusingly, the FCA are proposing PRIN 6 and 7 will remain in force, but only to the extent that they would apply in circumstances where the Consumer Duty does not apply.

Cross-cutting rules

The proposed cross-cutting rules have been amended slightly. The cross-cutting rules now being proposed require firms to:

- act in good faith towards retail customers;

- avoid causing foreseeable harm to retail customers; and

- enable and support retail customers to pursue their financial objectives.

Four Outcomes

In line with existing product governance requirements in the Handbook, the FCA propose to set different requirements for firms depending on their role in the distribution chain for:

- Manufacturers: firms that create, develop, design, issue, operate or underwrite a product or service would be regarded as a product manufacturer. More than 1 firm may be involved in the manufacture of a single product. It is also possible that intermediaries may be co-manufacturers, for example if they set the parameters of a product and commission other firms to build it.

- Distributors: firms that offer, sell, recommend, advise on, propose or provide a product or service would be regarded as distributors.

Product & Service Outcome

Manufacturers will be required to:

-

- develop an approval process for products or services;

- identify a target market of consumers for whose needs, characteristics and objectives the product or service is compatible;

- consider if there are any consumers with characteristics of vulnerability in the target market and take account of any additional or different needs of those consumers;

- test the product or service and ensure it is designed to meet the needs, characteristics and objectives of the target market;

- select distribution channels that are appropriate for the target market and provide adequate information to distributors to enable them to understand the product or service and the target market; and

- regularly review the product or service and its distribution, and take appropriate action to mitigate the situation if they identify circumstances that may adversely affect their customers.

Distributors will need to:

-

- develop distribution arrangements for each product or service distributed;

- get information from the manufacturer to understand the product or service, its target market and its intended distribution strategy; and

- regularly review the distribution arrangements to ensure they are appropriate and, if they identify issues, take appropriate action to mitigate the situation and prevent any further harm.

The FCA go on to remind distributors that they will have an additional responsibility in circumstances where the manufacturer is not subject to the Consumer Duty – for example, an overseas insurer.

Price and value outcome

This is an outcome primarily aimed at manufacturers, requiring an assessment of whether the price of a product/service provides fair value, and must include consideration of:

-

- the nature of the product or service, including the benefits that will be provided or that consumers may reasonably expect, and their quality;

- any limitations that are part of the product/service;

- the expected total price customers will pay; and

- any characteristics of vulnerability in the target market for the product or service.

Distributors will be required to satisfy themselves that their distribution arrangements are consistent with the product or service providing fair value.

Consumer Understanding Outcome

The FCA have renamed this outcome from ‘communication’, putting more focus on the need to “equip consumers to make effective, timely and properly informed decisions.”

It will require firms to ensure they:

-

- support retail consumer understanding so that their communications:

- meet the information needs of customers;

- are likely to be understood by the average customer intended to receive the communication; and

- equip customers to make decisions that are effective, timely and properly informed.

- communicate information to retail customers in a way which is clear, fair and not misleading;

- tailor communications taking into account the characteristics of the retail customers intended to receive the communication (including any characteristics of vulnerability), the complexity of the product, the communication channel used, and the role of the firm;

- provide information to retail customers that is accurate, relevant and on a timely basis;

- tailor communications to meet the information needs of individual customers and check the customer understands the information, where appropriate, when a firm is interacting directly with a customer on a one-to-one basis; and

- monitor, test and adapt communications to support understanding and good outcomes for retail customers.

- support retail consumer understanding so that their communications:

‘Understanding’ is most certainly a raising of the bar on communication and our expectation is that firms are likely to find it necessary to undertake far more detailed consumer testing to enable them to be confident of meeting this outcome.

Consumer Support Outcome

The FCA renamed this outcome from customer service to reflect the fact that the intended outcome relates to support across all consumer touch points. It was felt customer service carried with it an impression of post-sale support.

Firms must ensure that the support they provide is designed and delivered to an appropriate standard such that consumers do not meet unreasonable barriers when they want to pursue their financial objectives.

Firms must ensure:

-

- they provide an appropriate standard of support to retail customers such that it meets the needs of customers, including those with characteristics of vulnerability;

- retail customers can use products as reasonably anticipated;

- retail customers do not face unreasonable barriers (including unreasonable additional costs) when they want to pursue their financial objectives; and

- they regularly monitor whether they are providing an appropriate standard of support that meets the needs of – and does not disadvantage – retail customers, including those with characteristics of vulnerability.

Application of the new rules

The application of the new rules will be aligned with the position in the Insurance Conduct of Business Sourcebook (ICOBS). The same definition of ‘retail firms’ will apply.

All authorised firms would need to comply with the Consumer Duty for retail business for their own activities and in the normal course of events, firms would be responsible only for their own activities – there is no general expectation that firms would be responsible for the actions of other firms in the distribution chain.

However, where part of a distribution chain is outside the UK, those within the UK regulatory framework perimeter are expected to take all reasonable steps to ensure compliance. Those using non-admitted insurers for example, should take care.

Firms should also take note that the FCA propose that the Duty would apply to any firm that has a material influence over:

- the design or operation of retail products or services, including their price and value;

- the distribution of retail products or services;

- preparing and approving communications that are to be issued to retail clients; or

- direct contact with retail clients on behalf of another firm.

That would include firms who might consider themselves to act in a wholesale capacity.

The new duty will also apply to existing products if they continue to be sold or renewed after the duty takes effect. An implementation period would apply.

Responsibility

I said earlier that directors and board members should take note. The FCA have been very clear that they want responsibility and accountability to rest with the most senior individuals in the firm. Under the Consumer Duty, the firm’s board or equivalent management body, will be responsible for assessing whether it is delivering good outcomes for its customers which are consistent with the Consumer Duty.

This will be supported by the interaction between the Consumer Duty and the SM&CR. The SM&CR establishes clear senior management responsibility for compliance with the requirements and standards of the regulatory system and the new Consumer Duty raises this standard.

Monitoring Success

The new Consumer Duty is designed to be a principles based set of rules and as such, the evolution and testing of those rules will be an iterative process. The FCA will be looking for industry support to understand the outcomes which would be likely or unlikely to satisfy the Consumer Duty.

They have started the process by defining what they see success measures looking like. The FCA will look at a variety of sources of information including supervision and authorisation activities, firm management information (MI), future Financial Lives Surveys and complaints data. They are looking for improvements in:

- Fair value: Does the price consumer pay for products and services represents fair value and are poor value products and services being removed from markets leading to fewer complaints about poor value and unexpected fees or charges?

- Products and services: Are consumers being sold products and services that have been designed to meet their needs, with characteristics that lead to a reduction in the number of complaints about products and services not working as expected?

- Treatment: Are customers receiving good customer service leading to a reduction in complaints about switching, cancellation and service levels and customers having higher levels of satisfaction with the level of service they receive?

- Confidence: Do consumers have increased confidence in financial services markets as a result of the above and are they equipped with the right information to make effective, timely and properly informed decisions about their products and services?

Implementation

This is still in consultation phase, but the FCA have already started to consider the work involved for firms if they must implement the necessary change. Many firms highlighted this concern in the feedback and the FCA have recognised the significant work required.

A date of 30th April 2023 proposed, by which firms must have completed implementation of all necessary changes.

Monitoring Compliance With the New Consumer Duty

The FCA have been clear that it would expect firms to:

- monitor and regularly review the outcomes that their customers are experiencing;

- ensure that the products and services they provide are delivering the outcomes that they expect in line with the Consumer Duty; and

- identify where they are leading to poor outcomes or harm to consumers.

This would become a governance issue for the board and the FCA will amend the SM&CR individual conduct rules in the Code of Conduct sourcebook (COCON) to reflect the higher standard of the Consumer Duty. A new rule requiring all conduct rules staff within firms to ‘act to deliver good outcomes for retail customers’ where their firms’ activities fall within scope of the Consumer Duty will be introduced. Firms can expect to see FCA action across Authorisations, Supervision and Enforcement.

Conclusion

Anyone who thought the customer best interests rule was sufficient and adequately protects consumers from harm will by now be left under no illusion that the FCA do not share their optimism. The new Consumer Duty is a clear raising of the bar when it comes to the protection of consumer rights and the outcomes based approach will leave a lot of scope for firms and the FCA to debate whether or not a specific approach or process does indeed achieve any specific objective. Data and measurement will be key for firms to evidence compliance with the new duty.

Please get in touch if you would like to discuss any aspect of the new Consumer Duty with us.